Malaysia Government proposed in Budget 2012 that the RPGT on properties held and disposed of within two years be raised from 5% to 10%, 5% tax to be maintained for properties disposed after three to five years and no tax for properties disposed after the fifth year.

Meanwhile, the Government has provided exemption for following:-

- Disposal of a residential property once in a lifetime.

- Transfer as gifts between parent and child, husband and wife, grandparent and grandchild; (No exemption for transfer between sibling) and

- Exemption of RM10,000 or 10% of the chargeable gain, whichever is greater, for each disposal of a property by an individual.

Example to illustrate calculation of Real Property Gains Tax (RPGT) payable: Mr.X purchased a property on year 2006 at RM100,000.00 and sold after or on Jan 1 2010 at RM200,000.00 (within five years of the date of purchase). He made RM100,000.00 from the transaction and the gains are subject to 5% RPGT.

RPGT Calculation:

RM100,000 (Property Gains) - RM10,000 (Waived Exemption) = RM90,000 (Taxable Gains)

RM90,000 (Taxable Gains) x 5% (RPGT Rate) = RM4500 (RPGT Chargeable)

Effective January 1, 2012, property owners and investors who dispose off their property in Malaysia within five years will be subject to the revised RPGT rate on taxable capital gains for sale and purchase agreements signed on or after that date.

Basis Of Taxation

The chargeable gains arising from the disposal of any land situated in Malaysia and any interest, option or other right in or over such land or the disposal of shares in a 'real property company' is subject to Real Property Gains Tax.

Disposer's Responsibilities

The disposer of a real property has to submit the following within 30 days from the date of disposal of the asset:

- Completed Form CKHT 1;

- Copies of stamped Sale and Purchase Agreement or Form 14A (memorandum of transfer) to prove the acquisition and disposal of the asset;

- Copy of grant/title deed (if any);

- Copies of bills and receipts for expenses claimed. (in case of companies or non-citizen and non-permanent resident individuals, details not required if asset is disposed in the sixth or subsequent year from the date of acquisition).

Acquirer's Responsibilities

An acquirer has to submit the following within 30 days from the date of disposal of the asset:

- Completed CKHT 2 forms;

- Copy of stamped Sale and Purchase Agreement or Form 14A (memorandum of transfer) to prove the acquisition;

- Copy of grant/title deed (if any).

Acquirer (or his solicitor) is also required to retain the whole of the consideration monies or a sum not exceeding five percent (5%) of the total value of the consideration whichever is the lower, until he receives clearance (Form CKHT 4 or CKHT 5) from the Inland Revenue Board.

Exemptions Available For Real Property Gains Tax (RPGT)

- A gain arising on disposal prior to 7 November 1975, the date of coming into force of the RPGT Act 1976.

- An amount of RM5,000 or 10% of the chargeable gain, whichever is greater, for each disposal of a property by an individual.

- A gain accruing to the Government, a State Government or a local authority.

- A once in a lifetime exemption on a gain accruing to an individual who is a citizen or a permanent resident or to a husband and wife in respect of the disposal of two private residence (each for husband and wife as amended in Budget 2005).

- A gain equal to the amount of estate duty payable where the disposer is compelled to dispose the property in order to pay the estate duty.

A No Loss And No Gain Situation

Applicable only to companies (as defined in the RPGT Act 1976) for the following situations:-

- Transfer of asset between companies in the same group to bring about greater efficiency in operation for a consideration consisting of not less than 75% syer in the transferee company and the balance of a money payment.

- Transfer of asset between any companies for any consideration in any scheme of reorganisation, reconstruction or amalgamation whereby the transferee company is being restructured to implement any such scheme in compliance with Government policy on capital participation in industry.

- Distribution of asset by a liquidator of a company and the liquidation of the company was made under a scheme of reorganisation, reconstruction or amalgamation whereby the transferee company is being restructured to implement any such scheme in compliance with Government policy on capital participation in industry.

Several Transactions Where Disposal Price Is Deemed Equal To Acquisition Price:

- Transfer of assets between spouses.

- Gifts made to the Government, State Government, local authority or a charity exempt from income tax.

- Disposal of an asset as a result of a compulsory acquisition under any law.

- Disposal of an asset by a person to an Islamic Bank under a scheme where that person is financed by such bank in accordance with the Syariah.

Rates Of Tax (Real Property Gains Tax)

The above rates apply for disposals on or after 27 October 1995 and has been revised to 5% flat with effective from Jan 1 2010. An individual who is not a citizen and not a permanent resident is subject to the following rates:-

These rates apply for disposals on or after 17 Oktober 1997.

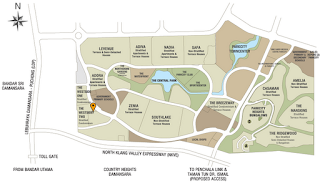

Land area : 4.2 acres

Land area : 4.2 acres